Goldman Sachs has released an upgraded forecast for Australia’s economy that reflects much higher predicted economic growth and a higher Australian dollar. The Australian economics team at Goldman Sachs, which consists of Tim Toohey, Andrew Boak and Bill Zu, also expect that the RBA will lift interest rates as soon as late 2017.

The team believe that the Australian economy has experienced “an important transition point” that will lead to faster economic growth.

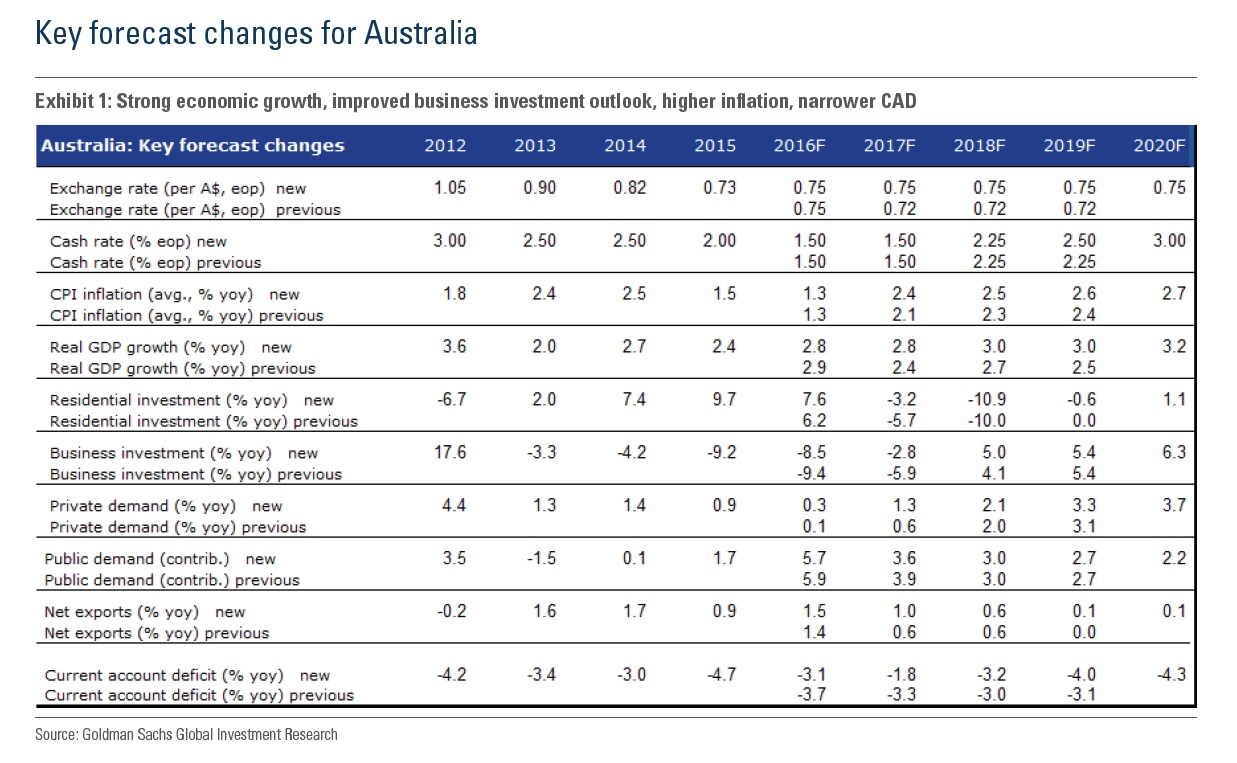

“We have upgraded our economic growth forecasts for Australia and now forecast economic growth will average 2.8% in 2017, 2.9% in 2018, 3.0% in 2019 and 3.3% in 2020,” said Toohey, Boak and Zu. This figure represents a 40 percent point rise in 2017, 10 percent points the next year and 50 percent points in 2019.

The team also lifted the forecasts for the Australian dollar from 75c to 78c over the next three months, from 73c to 77c over six months and from 72c to 75c over a year. This optimistic view is driven by a recent price spike in Australia’s key exports that has seen coal prices rise by 300% this year and iron ore jump by 80%.

Goldman Sachs’ predictions come on the heels of the far more gloomy view presented by Macquarie Bank last week. Macquarie believe that slower economic growth and further interest rate cuts from the RBA will occur thanks to the uncertainty stemming from the election of US President Donald Trump.

Macquarie’s Head of Australian Economic Research expects that Australia’s real GDP growth will be only 2.1% next year, and predicts that the RBA will reduce interest rates to 1% with two rate cuts early in the year.

The sharp contrast between these two expert forecasts is a measure of the uncertain economic climate worldwide and how drastically it can affect Australia’s economy.

Leave a Reply