Forbes recently released a study into which top seven countries were the most vulnerable to a debt crisis in the next 1-3 years, and we in Australia were #2 – second only to China.

Australian economist Steve Keen writes for Forbes that the same financial mishaps that were the cause of the Global Financial Crisis are likely to cause debt crises in these countries, which include Sweden, Hong Kong, Korea, Canada and Norway as well as China and Australia.

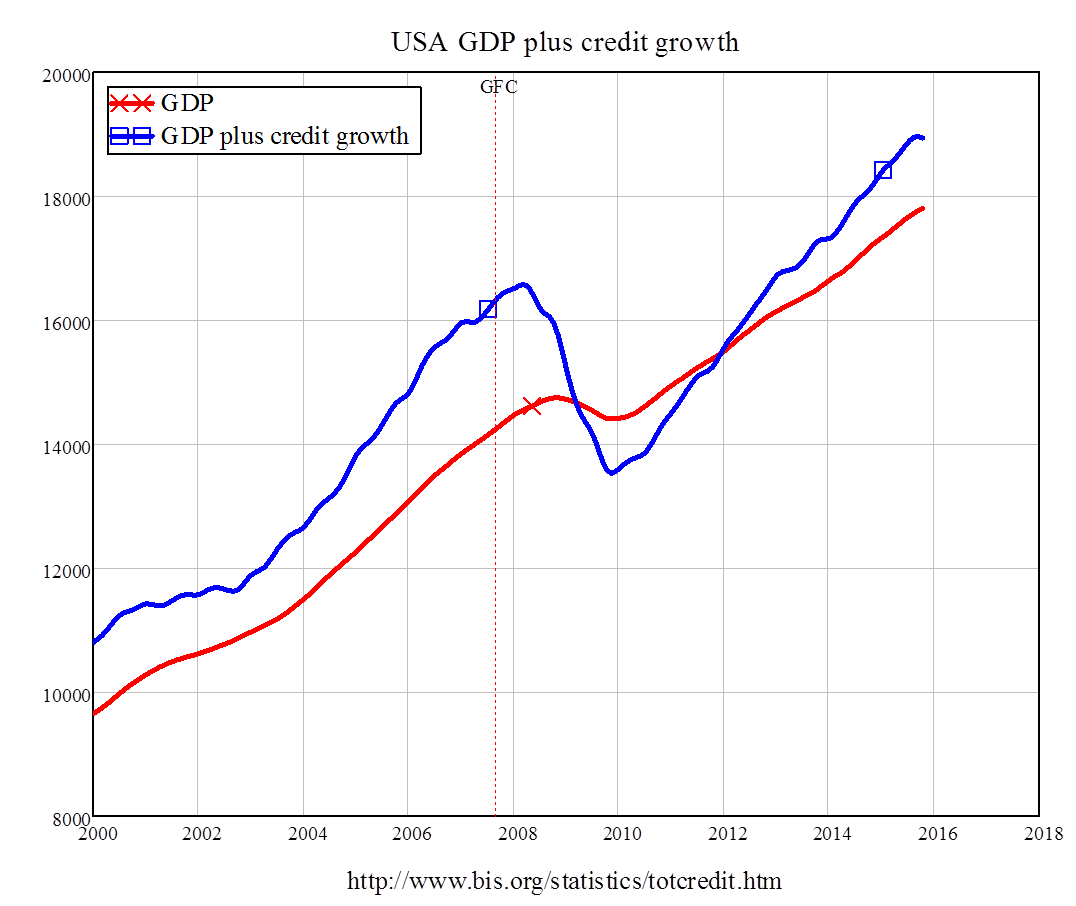

He uses data of both public and private debt, comparing the growth of credit with the GDP, in particular the effects evident when credit growth falters. He uses the US prior to the GFC as evidence of the correlation between these two factors, concluding that when credit growth slips, servicing debt exhausts the funds to finance it, which leads to an ultimate change in available credit – impacting all aspects of economics.

The two warning signs Keen provides are a high ratio of private debt to GDP and a rapid growth of said ratio in previous years. Unfortunately, Australia fulfils these two criterions, which is why Keen places it so high on his list. He narrowed his search by restricting it to those countries with a private debt to GDP ratio higher than 175% of GDP, and then for the second criteria he limited it to countries where increase in private debt last year exceeded 10% of GDP.

The precise timing of these apparently imminent financial crises is impossible for Keen to deduce, but that won’t stop him from maintaining that they are going to happen, and they are going to happen soon.

Leave a Reply